This is a guest blog for a company that I personally have a great deal of respect for: Digital Leadership Associates. Given that they are world renowned thought leaders in Social Selling, I thought it would be worth considering the growing role of Social in Customer Service.

In these days of customer empowerment, it is becoming an increasingly common occurrence. Customer frustration or dissatisfaction boils over onto our Social feeds. In the past, we would either have shrugged our shoulders or written to complain. The growth in Telephony enabled us to vent at poor Customer service Agents. However, the Internet now offers all sorts of possibilities to make Suppliers squirm. Social Complaining has now even got a monetary value according to The Spectator.

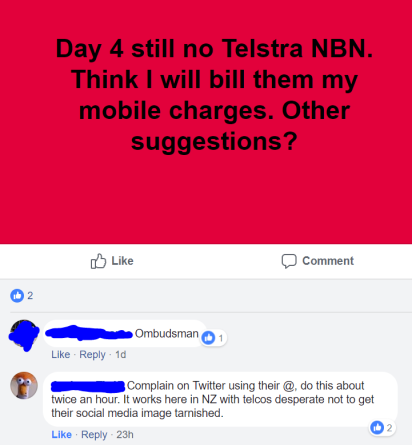

The example below was typical of many others and the response emphasizes the dilemma now being faced by many organisations.

Customers are using the potential for posts to go “viral” to get something done. This method bypasses traditional complaints management processes and has the ability to cause damage right up to the highest levels of an organisation.

The challenge for Organisations is complex and multi faceted. How to save face, how to treat ALL customer fairly, irrespective of channel, how to respond, how to be proactive etc

So what can Suppliers do?

Firstly, recognise the way in which your customers wish to engage you through Social Media. It may not be to complain but to ask questions or even compliment you. The major UK pub chain, Wetherspoons, recently announced its decision to close its Social Accounts

I do not see that this will help Wetherspoons in remaining engaged with or “connected” to their customers. It is the first public example I have seen of burying your head in the sand. It will not stop people from commenting about the brand whether positively or negatively. However, it will reduce the costs of administering their Social Accounts.

Secondly, identify the Social Channels that you are committed to and learn how to use them professionally. Like anything else, the likes of Twitter, Instagram and Facebook are tools that in the right hands can do good, in the wrong hands can harm. Make sure you post appropriately, integrate to conventional channels and “listen” to the noise to detect early signs of an issue.

There was a famous Australian example as long ago as 2009 when a bank turned a customers Twitter rant into a positive outcome. However, this merely encouraged others to get quicker and more fruitful outcomes by taking to Social Media. However, at least they were listening and mitigated any reputational damage to their brand.

Finally, consider how Social can help you create genuine differentiation through service. Why not encourage users to engage with you and use social to get answers to questions, chase up orders and get a more personalised service. The technology exists to do some pretty amazing things and it starts by understanding the persona’s who engage with you and their particular journeys. Design from the “outside-in” and incorporate Social service within these journeys.

My hope is that Social evolves from being a tool used by complainers to getting quick results through “shaming” into a media which is used by organisations to offer outstanding service excellence negating any need for people to rant. I can live in hope….